In August 2024, financial markets reacted sharply when the US unemployment rate climbed to 4.2 percent. The move triggered the widely watched Sahm Rule, a recession indicator that has historically signalled the early stages of economic downturns. Equity markets responded with immediate volatility, reinforcing public anxiety about whether the global economy was once again approaching contraction.

Yet behind these headline signals lies a deeper question. Are traditional recession indicators still reliable in an era shaped by post-pandemic labour disruptions, artificial intelligence adoption and shifting workforce dynamics? A study published in Business Economics and led by Raffaele M. Ghigliazza of Princeton University and Qwanteq, introduces a novel framework designed to reinterpret unemployment cycles using advanced time series alignment methods .

Titled “Where are we in the cycle?”, the study proposes a universal economic cycle clock that attempts to standardise how labour market downturns evolve over time. Rather than relying solely on rigid recession thresholds, the approach seeks to align historical unemployment patterns into a unified structural timeline.

The limits of traditional recession indicators

The Sahm Rule has gained popularity because of its simplicity and historical reliability. It triggers when the three-month moving average of the unemployment rate rises by at least 0.5 percentage points from its lowest value over the previous year. In past downturns, this indicator has consistently provided early warning signals of recessions.

However, business cycles do not unfold at identical speeds or follow uniform shapes. Some recessions accelerate rapidly, while others develop gradually and exhibit long recovery tails. Applying a single numerical threshold to all cycles risks misinterpreting temporary fluctuations as structural downturns.

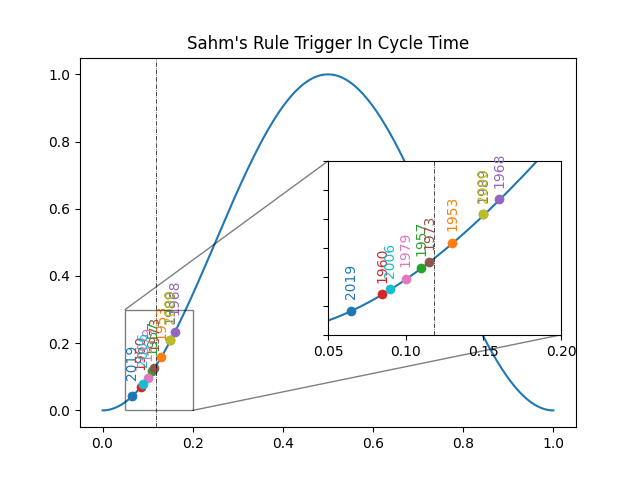

Ghigliazza’s analysis shows that while Sahm Rule activations tend to cluster near the early stages of major unemployment cycles, they capture only a single moment within a broader dynamic. Without understanding the overall structural position of the labour market cycle, recession indicators may offer incomplete guidance for economic forecasting and policy intervention.

The universal cycle clock

At the core of the study lies a technique known as Dynamic Time Warping, a pattern-matching algorithm originally developed for speech recognition and signal processing. Ghigliazza applies this method to decades of US unemployment data, aligning historical cycles not by calendar time but by structural similarity.

The result is what the author describes as a universal cycle clock. This framework maps unemployment cycles onto a standardised phase timeline ranging from early onset through peak distress and eventual recovery. By doing so, it becomes possible to compare cycles that differ significantly in duration and intensity while preserving their internal structural features.

Unlike conventional trend analysis, the universal clock does not rely on derivative calculations that amplify noise in economic data. Instead, it uses a smooth reference template to anchor inflection points and turning phases. Each historical cycle is then warped to fit this template, allowing economists to assign consistent phase labels even to noisy or incomplete datasets.

What history says about labour market cycles

When applied to post-war US labour market data, the universal cycle clock reveals striking diversity in how unemployment cycles unfold. Some downturns display near symmetry, with comparable rates of labour market deterioration and recovery. Others feature abrupt job losses followed by prolonged stagnation in employment conditions.

The study highlights cycles such as those following the oil shocks of the 1970s and the global financial crisis, which exhibited particularly long recovery tails. In contrast, other episodes, such as the late 1950s downturn, showed relatively balanced trajectories.

These findings challenge the assumption that recessions follow predictable shapes. Instead, the data suggest that economic shocks interact with structural conditions such as monetary policy, sectoral composition, and labour market frictions, producing highly variable recovery paths.

Where the Sahm Rule fits within the new framework

One of the most important outcomes of the research is the placement of Sahm Rule triggers within the universal cycle clock. On average, the indicator activates at approximately 11.9 percent into the structural unemployment cycle, placing it near the onset phase rather than near peak distress.

This finding supports the rule’s reputation as an early warning signal. However, it also highlights its limitations. The Sahm Rule captures the beginning of a broader cycle rather than providing a full diagnosis of its eventual severity or duration.

By pushing recession indicators into a continuous structural timeline, the universal clock allows economists to interpret signals within a broader context. This shift moves recession analysis away from binary trigger events and toward a more nuanced understanding of cyclical evolution.

Beneath the surface of today’s labour market

Despite relatively low headline unemployment rates, Ghigliazza’s study identifies several warning signs beneath the surface of current labour market conditions. One key indicator is the ratio of job openings to unemployed workers, which surged during the post-pandemic recovery but has since fallen sharply back toward pre-COVID levels.

Another concern is the persistence of elevated unemployment durations. Average weeks spent unemployed remain unusually high relative to the current jobless rate. This decoupling suggests growing frictions in labour matching, as workers struggle to transition efficiently between sectors.

Long-term unemployment also remains elevated compared with historical norms outside recession periods. Traditionally, this measure declines steadily during economic expansions. Its recent stagnation may indicate hidden slack in the labour market that standard metrics fail to capture.

Artificial intelligence and the risk of structural disruption

Beyond cyclical indicators, the study explores the potential of artificial intelligence adoption as a structural driver of labour market change. Sector-level data shows uneven hiring dynamics, particularly within white-collar industries where automation and AI tools are increasingly integrated into workflows.

The research identifies a decline in relative hiring strength in the administrative, information processing, and professional services sectors. Meanwhile, selected industries such as financial services and technology continue to show stronger recruitment activity, reflecting differential adoption patterns.

Firm-level layoff announcements reinforce these trends. Major corporations, including IBM, Microsoft, and Meta, have publicly attributed workforce reductions to automation and AI efficiency gains. Surveys indicate that generative AI adoption rose rapidly between late 2024 and early 2025, particularly in customer service, marketing and IT functions.

While AI adoption also creates productivity gains and demand for complementary skills, the uneven pace of transition risks amplifying labour displacement in entry-level and routine cognitive roles. This asymmetric disruption may contribute to longer unemployment spells and delayed workforce reintegration.

Dynamic Time Warping does not find inflection points; it inherits them from a structural template, providing a stable way to interpret early-cycle signals without relying on noisy derivatives. While linking current signals to a new cycle is necessarily speculative, persistent deviations from historical labor market patterns suggest that deeper structural imbalances may be emerging.

– Raffaele M. Ghigliazza

From economic triggers to system dynamics

Ghigliazza’s analysis extends beyond statistical classification by drawing on concepts from dynamical systems theory. In this framework, economic downturns are interpreted as transitions between stable and unstable system states, often driven by slow-moving imbalances that eventually trigger self-reinforcing cycles.

Such bifurcation dynamics have been observed in macroeconomic models where delayed wage adjustments and employment feedback loops generate endogenous oscillations. Importantly, these transitions are difficult to detect in real time. Indicators such as the Sahm Rule or unemployment rate thresholds can signal stress, but cannot determine whether the economy will absorb the shock or enter a prolonged downturn.

By combining structural cycle alignment with system-level interpretation, the universal clock provides a richer analytical lens. It allows economists to contextualise early warning signals within broader feedback-driven processes that shape long-term economic trajectories.

Reference

Ghigliazza, R. M. (2025). Where are we in the cycle? Business Economics. https://doi.org/10.1057/s11369-025-00432-3